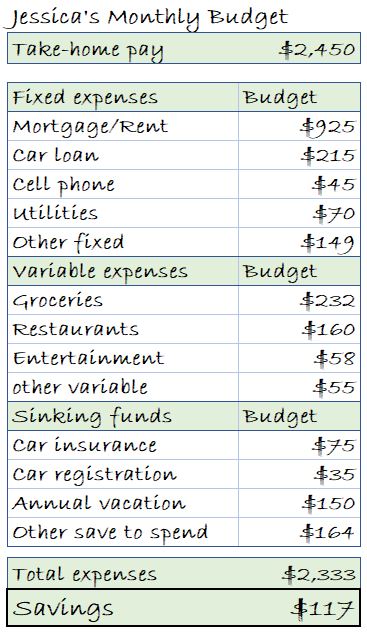

Once you’ve written everything out, subtract the expenses from the income.

That’s why zero-based budgeting is particularly helpful for consumers with a variable income. This way, you’re only using money that’s already in your bank account and not relying on a future paycheck. One feature of zero-based budgeting is that you use last month’s income to determine how much you can spend. You can use your monthly credit card and bank statements to estimate a realistic figure. Then, decide how much you want to allocate for each specific category by looking at how much you currently have in your checking account. If you need to budget for travel or save up for a new car, those should also be categories. In addition to creating categories for your living expenses, you’ll also need to create categories for your financial goals, whether that be for savings or paying off debt. Debt including student loans, credit cards, and personal loans.Start by making a list of all the categories where you spend money every month.

Essentially, with a zero-based budget, you want your income minus your expenditures to equal zero at the end of every month. The goal of a zero balance budget is to assign all of your income to specific categories until there’s no money left over. With a 0 based budget, you will want to keep track of absolutely everything that you spend money on. If productivity, efficiency, and structure are important to you, then this system might be just what you’re looking for. You can use an investment calculator to figure out exactly how much you can realistically put towards investments based on your income. The difference between a regular budget and a zero-based budget is that a traditional budget allows leftover money to sit in your checking account.Ī zero-based budget would require that you move those extra funds to savings, debt payoff, investments, or some other goals. At the end of the month, a zero-based budgeting system lets you know where 100% of your income went.

Zero-based budgeting, also known as zero-sum budgeting, centers around the principle that every dollar in your budget should be categorized. Zero-Based Budgeting Can Help You Organize Your Finances.How Does it Compare to Other Budgeting Methods?.Read on to find out if this strategy is right for you, or use the links below to navigate the article. In this chapter, we’ll be discussing the zero-based budget definition, how you can create a zero balance budget, the pros and cons of this method, what to include in your budget, and more.

#Budgeting 101 creating a personal budget how to

We’ve also discussed various other ways on how to create a budget, like with a free budget template or with the 50/30/20 budget rule. In this series, we’ve already gone over several important topics about budgeting, like what a budget is, what to include in your budget, and how you can create a budget with Mint. Zero-based budgeting is one of the most popular ways to do this. It’s also the best way to plan and save for the things that are most important to you, like a vacation to Bali or a down payment on a new home. Whether you make six figures a year or minimum wage, every dollar you bring in is an opportunity to make more.īut strategically allocating your finances is about more than just funneling money into your investment accounts. Putting your money to work is one of the best ways to maximize your financial potential.

0 kommentar(er)

0 kommentar(er)